Tax Crime Junkies

Hey there, Tax Crime Junkies! For those of you who are new to our show, Tax Crime Junkies is the true crime podcast that combines our love of taxes and crime, and we’re here to bring you the inside scoop on some of the most fascinating tax-related cases out there. As tax experts and practitioners ourselves, Dom and Tom are uniquely qualified to uncover the most intricate details of these cases, and we’re not afraid to go deep. We know the ins and outs of the tax system, and we’re passionate about bringing our knowledge to you, our devoted listeners. From embezzlement and fraud to money laundering and more, we’ve covered some of the most shocking tax crimes out there. We’ve talked to experts, lawyers, and even some of the criminals themselves to get a better understanding of what drives people to commit these crimes and how they get away with it for so long. But we’re not just here to entertain you with tales of tax crime. We’re also dedicated to educating our listeners about the importance of proper tax compliance and helping business owners avoid making costly mistakes that could land them in hot water with the IRS. So whether you’re a true crime buff, a tax professional, or just someone who wants to learn more about the seedy underbelly of the tax world, Tax Crime Junkies has something for you. So keep tuning in, keep spreading the word, and keep those five-star reviews coming! Thanks for listening!

Episodes

Friday May 23, 2025

Friday May 23, 2025

What happens when a man who built a $200 million business on lies tries to warn you about someone else’s fraud?

In this Tax Crime Junkies Fine Line Files special edition, Dominique sits down with Barry Minkow—the teenage mastermind behind ZZZZ Best, the ex-con-turned-pastor-turned-SEC informant—for a one-of-a-kind interview.

But this isn’t the redemption arc you might expect.

Instead, Dom gets a front-row seat to monologue filled with red flags, Reg D horror stories, and just enough self-awareness to leave you wondering: Is he helping protect people—or just starring in his next act?

In this episode, you’ll hear:

🔹 Why Reg D investment deals are a playground for fraud🔹 How repeat offenders can sound convincing—even while making confessions🔹 What Barry says about his own history, and the victims he now advocates for🔹 The subtle, dangerous charisma of a career con man

And the chilling takeaway from Barry himself:

“Perpetrators of financial fraud can’t guard the front door. And only a crook like me would know that.”

🎧 This episode is a warning, a case study, and a reminder: even a man who lies for a living can sometimes tell the truth. But that doesn’t mean you should trust him.

Call to Action:Have you seen a shady Reg D deal pitched to one of your clients? Know a repeat fraudster who keeps popping up in the industry? We want to hear your story. Leave us a voicemail on our hotline or DM us @TaxCrimeJunkies.

Subscribe, share, and remember:Stay curious.Stay vigilant.And stay on the right side of The Fine Line.

Wednesday May 07, 2025

Wednesday May 07, 2025

He was a teenage millionaire. A carpet-cleaning king. A Wall Street darling. Then, a convict. Then, a pastor. Then… a convict again.

In this jaw-dropping episode of Tax Crime Junkies, Dom and Tom unravel the unbelievable story of Barry Minkow, a man whose life has more plot twists than a Hollywood thriller (ironically, there is a Hollywood movie about him—he starred in it as himself).

We begin in Reseda, California, where 16-year-old Barry launched ZZZZ Best, a carpet cleaning company that he turned into a $200 million publicly traded corporation... built entirely on lies. But Minkow didn’t stop there. After being convicted of 57 felonies and spending years in prison, he reinvented himself as a pastor and fraud investigator—only to fall back into scandal, stealing millions from his own congregation and defrauding investors again.

In this episode, you'll hear:

🔹 How Barry faked restoration jobs, forged documents, and got mob ties to help his company go public🔹 His time in prison and seemingly miraculous comeback as a man of faith and fraud-busting crusader🔹 The real story behind the self-funded biopic "Minkow" — and the new crimes he committed while filming it🔹 How he ran scams from the pulpit, stealing from widows and churches, and manipulated the justice system🔹 Why even after serving two prison terms, Barry is still out there today... on TikTok, Instagram, and filing whistleblower claims with the SEC

This episode isn't just a cautionary tale about fraud—it’s a look into the psychology of a man addicted to the con. Barry’s story raises deeper questions: Can a person like him ever be reformed? Or does the con always find its way back in?

Key Takeaways:

✅ Some Ponzi schemes are built on greed—others on charisma, charm, and a craving to be adored✅ Redemption stories can be real… but sometimes they’re just sequels to a long-running scam✅ If the pastor’s asking for a PayPal account linked to your Discover card, maybe say no

📲 Subscribe, rate, and share if you love true crime, financial fraud, and untangling the lies behind the biggest scams in tax history.

📸 Follow us on Instagram and X: @TaxCrimeJunkies🎧 Available wherever you get your podcasts.

Wednesday Apr 30, 2025

Wednesday Apr 30, 2025

Episode Summary:

After the rise and fall of San Diego real estate mogul Gina Champion-Cain—and her infamous $400 million Ponzi scheme—Dom is back with a solo deep dive into how these schemes actually work and, more importantly, how you can protect yourself from becoming the next victim. From fake escrow officers (looking at you, Wendy Reynolds) to catfishing crypto investors with “pig butchering” scams, this episode is your survival guide to spotting fraud before it bankrupts your wallet and your faith in humanity.

What You’ll Learn:🔍 The psychological tricks scammers use to win your trust💰 The anatomy of a Ponzi scheme—and how to recognize one from a mile away🚩 Red flags that mean “get out now” (including promises of guaranteed returns and urgency tactics)📉 Why real investing should be boring—and why exciting means “investigate further”👀 How to vet people, projects, and platforms before investing a single dollar

Real Talk Quotes from Dom:💬 “If it smells like Wendy Reynolds, it’s probably a scam.”💬 “Real investing is boring. But boring doesn’t end with the FBI seizing your beach house.”💬 “Don’t get caught sending your life savings to a guy named ‘CryptoBrad_420’ with an Instagram full of borrowed Lamborghinis.”

Resources Mentioned:

FINRA BrokerCheck

SEC Investment Scam Alerts

Secret Service Crypto Fraud Reporting

AARP Fraud Resource Center

Why You Should Listen:✔️ You’re curious about how Ponzi schemes work and why they’re still so effective✔️ You want to protect yourself (or a friend) from online romance-investment fraud✔️ You love a good story and a healthy dose of fraud-sniffing sarcasm

🎧 Listen Now on: Apple Podcasts, Spotify, Google Podcasts, or wherever you get your scams—I mean, shows.

📨 Have a story tip or fraud tale of your own?Drop us a line—anonymous confessions welcome.

Until next time:Stay curious. Stay vigilant. And stay on the right side of the fine line.

Wednesday Apr 23, 2025

Wednesday Apr 23, 2025

In this gripping episode of Tax Crime Junkies, we dive deep into the rise and fall of Gina Champion-Cain, a woman who once enjoyed the high life of San Diego’s real estate elite—until she became the mastermind behind one of the most infamous Ponzi schemes in history.

Gina Champion-Cain, self-proclaimed “nice Catholic girl from Michigan,” made a name for herself in the real estate world, taking on high-profile projects and even earning accolades such as “Gina Champion-Cain Day” in San Diego. But behind the glamorous exterior, her empire was built on lies, deception, and millions of dollars siphoned off from unsuspecting investors.

We take you through the fascinating story of how Gina’s ambition, fueled by desperation and the desire to maintain her image, led her down a criminal path. With a carefully crafted Ponzi scheme disguised as a legitimate liquor license lending program, Gina manipulated friends, business partners, and even her trusted employees into believing they were part of something successful—when in reality, it was all a fantasy.

In this episode, you’ll learn:

The Rise: From college dropout to a successful real estate mogul, Gina’s journey to the top included some bold moves, but also some major fabrications in her business dealings.

The Fall: The unraveling of Gina’s Ponzi scheme, which led to charges of conspiracy, securities fraud, and obstruction of justice. We explore how her financial house of cards collapsed and the devastating impact it had on her victims.

The Method: Learn how Gina operated her Ponzi scheme, including how she used fake names, forged documents, and manipulated escrow accounts to deceive investors. She even created a fake escrow officer, Wendy Reynolds, who never existed.

The Consequences: Discover how Gina’s actions impacted her victims—some of whom were lifelong friends—leading to a cumulative loss of over $183 million. We also discuss the role of Chicago Title and the complicity that led to a $187 million settlement for victims.

The Redemption? After her conviction, Gina claims to have turned a new leaf, but is her redemption story just another attempt to please people? What’s next for the woman who once made her living off of lies?

Key Takeaways:

Gina’s rise to fame was built on talent, charisma, and deception. She knew how to make people believe in her, even when her business dealings were anything but legitimate.

The psychological profile of a Ponzi schemer: Gina’s addiction to pleasing people and maintaining her image led her to cross moral and legal lines, leaving a trail of broken trust in her wake.

The fallout from Gina’s Ponzi scheme affected hundreds of investors, from wealthy individuals to friends and family members who had placed their trust in her.

Despite claiming she wants to help her victims recover, Gina’s history raises questions about whether she can truly turn over a new leaf—or if her desire to “help” is just another part of her con.

Stay tuned for more juicy details and shocking revelations as we uncover the story of one of the most prolific female Ponzi scheme artists in history.

Subscribe to Tax Crime Junkies for more stories about financial crimes and the trail of deceit they leave behind. We’re here to uncover the truth and expose the scams that fool even the most seasoned investors.

Follow us on social media @TaxCrimeJunkies for updates and exclusive content.

Wednesday Apr 16, 2025

Wednesday Apr 16, 2025

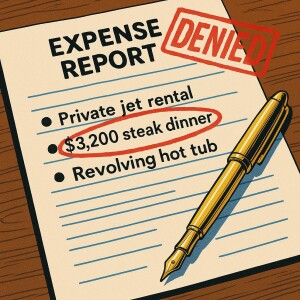

Episode Summary:

What happens when the person sworn to protect your paycheck is secretly shopping for a yacht on the company dime?

In this episode of The Fine Line Files, Dom dives solo into the murky waters of leadership corruption—from union bosses with designer tastes to corporate execs who think “transparency” is a four-letter word. Building off the Tax Crime Junkies episode Blue Betrayal: How a Union Boss Went Rogue, this episode peels back the curtain on how unethical leadership starts, how to spot it, and why your financial future depends on speaking up. Listen in to hear how far the corruption extends beyond just Karen Read!

💡 What You’ll Learn:

What the heck is going on with union embezzlement—and why it matters

The 5 unmistakable red flags of unethical leadership (file under: 🚩🚩🚩)

How even nonprofits and government agencies fall into the fraud trap

Why transparency isn’t just a buzzword—it’s a lifeline

The hilarious (and horrifying) ways corrupt leaders fail to cover their tracks

What YOU can do to protect your organization, your money, and your peace of mind

🧠 Notable Quotes:

💬 “If your union boss is vacationing in Bali while you’re still waiting for dental benefits... congratulations, you’ve spotted a corruption unicorn.” – Dom💬 “Honestly, if your leader dodges questions about finances like a raccoon avoiding a flashlight, that’s not visionary leadership—it’s a red flag buffet.” – Dom💬 “Fraud doesn’t always wear a ski mask. Sometimes, it wears a tailored suit and has a very convincing PowerPoint.” – Dom

✅ Why You Should Listen:

✔️ You’ve worked in or around leadership and want to understand the signs of financial misconduct✔️ You’re fascinated by the intersection of money, power, and moral flexibility✔️ You’ve got a sense of humor—and a healthy distrust of unmonitored expense accounts✔️ You want to make sure your organization doesn’t end up in next week’s episode

📢 Listen Now On:

Spotify, Apple Podcasts, Amazon Music, and everywhere you like to binge your financial fraud with a side of sarcasm.

🎧 Don’t forget to subscribe, leave a review, and share with your favorite board member (the one who still uses AOL mail).

💌 Got a Story Idea?

Have a hot tip or tale of shady leadership? Slide into our inbox—we’d love to hear it.

Until next time... stay curious, stay vigilant, and stay on the right side of the fine line.

Wednesday Apr 02, 2025

Wednesday Apr 02, 2025

In this week’s episode of Tax Crime Junkies, we take you behind the badge into one of the most shocking scandals to hit the Massachusetts State Police union. Meet Dana Pullman, the union boss who turned SPAM (State Police Association of Massachusetts) into his personal piggy bank. From backdoor kickbacks to romantic getaways funded by union dues, Pullman’s crimes weren’t just a betrayal of his organization—they were a masterclass in how not to run a union.

Join Dominique and Tom as they unravel the fraud, bribes, and downright audacity that led to Pullman’s downfall. Along the way, they’ll explore how the IRS pieced together the trail of corruption and share how even small financial missteps can lead to massive legal consequences. Listen in to hear how far the corruption extends beyond just Karen Read!

What You’ll Learn in This Episode:

How Dana Pullman misused police union funds for personal gain.

The role of kickbacks and disguised payments in Pullman’s schemes.

How the IRS uncovered the fraud and tied it to false tax returns.

The importance of receipts, documentation, and transparency (hint: don’t throw away your expense reports).

How Pullman’s defense attorney tried to argue “bad vibes” instead of facts.

Episode Highlights:

Union Funds Gone Wild: From $9,000 in flowers to $2,000 in iTunes charges, Pullman treated the union debit card like his personal expense account.

Kickbacks and Coverups: Learn how Pullman and lobbyist Anne Lynch funneled bribes disguised as “consulting fees” and thought they could outsmart the IRS.

Romantic Getaways: When union dues become a ticket to Miami—and how the IRS found out.

The Vibes Defense: Yes, you read that right—Pullman’s lawyer argued the prosecution was based on “bad vibes.”

The Fallout: Jail time, fines, and the lingering impact on the union and its members.

Memorable Quotes:

“If you’re going to steal, don’t use the company debit card. And maybe, just maybe, keep the receipts.” – Dom

“When your treasurer tells you the union is ‘getting screwed,’ maybe take the hint.” – Tom

“Vibes don’t pay taxes, and they definitely don’t cover fraud.” – Dom

Resources and Links:

Learn more about us at taxcrimejunkies.com

Follow us on social media: @taxcrimejunkies on Twitter and Instagram

If you enjoyed this episode, don’t forget to subscribe, rate, and leave a review! Your support helps us keep bringing you the wildest tales of tax crimes and financial fraud. Have a story idea or feedback? Reach out to us on our website or social media—we’d love to hear from you!

Wednesday Mar 26, 2025

Wednesday Mar 26, 2025

The Fine Line Files: Life Insurance and Fraud – When Death Becomes Profitable

Episode Summary:

Life insurance is meant to provide financial security for loved ones after a loss. But what happens when a policy becomes a motive for crime? In this episode of The Fine Line Files, we explore the dark world of life insurance fraud—from suspicious claims to staged deaths, foreign death fraud, and the murky legal landscape that insurers must navigate when fraud is suspected.

We’ll break down the financial incentives behind suspicious life insurance claims, the warning signs investigators look for, and the infamous cases where life insurance played a pivotal role in premeditated crimes. And, as a shocking twist, we’ll discuss how some fraudsters fake their own deaths, including the bizarre case of QuadrigaCX’s Gerald Cotten—whose mysterious death in India left investors missing millions in cryptocurrency. Did he really die, or did he disappear with the money?

From legal loopholes to exotic schemes that involve fake documents and even morgue bribery, we explore the fine line between a tragic accident and a criminal conspiracy.

What You’ll Learn in This Episode:

💰 The Psychology Behind Suspicious Life Insurance Claims – Why financial incentives can drive crime💰 How Investigators Spot Red Flags in Fraudulent Claims – The key evidence insurers use to detect deception💰 The Fine Line Between an Accident, Suicide, and Premeditated Murder – When life insurance becomes a motive💰 How Some People Fake Their Own Deaths – From fake documents to staged bodies, the underground business of vanishing💰 The QuadrigaCX Scandal & Gerald Cotten’s ‘Death’ in India – When millions in cryptocurrency disappear with the deceased

Episode Highlights:

🔹 A Policy Too Convenient – Why sudden life insurance policy changes before death are a red flag🔹 The Foreign Death Conundrum – How insurers investigate claims from unfamiliar jurisdictions🔹 The Dark Side of Insurance – Famous fraud cases where murder was the ultimate financial plan🔹 The ‘Death Kit’ Market – The shocking ways criminals fake their deaths, from phony documents to bribed officials🔹 QuadrigaCX & The Missing Millions – How a crypto CEO’s mysterious death in India left investors stranded and sparked conspiracy theories

Memorable Quotes:

📝 “Sometimes, the biggest red flag in a life insurance case isn’t the death itself—it’s the money trail left behind.”📝 “If you think faking your death is impossible, think again—there’s an entire underground industry making it happen.”📝 “When the only asset in the will is a life insurance policy, it’s time to start asking questions.”📝 “Is Gerald Cotten dead—or is he sipping cocktails on a beach, laughing at the crypto world?”

Resources & Links:

🔎 Learn More About Life Insurance Fraud: Corporate Finance Institute – Fraud Red Flags🔎 Investigating Suspicious Deaths Overseas: Watkins Firm – Commingling Funds & Assets🔎 What to Do If You Suspect a Fraudulent Life Insurance Claim: Indinero Guide

📩 Have a tip or case suggestion? Contact us at TaxCrimeJunkies.com📣 Follow us on social media: @TaxCrimeJunkies on Instagram & Twitter🎧 If you enjoyed this episode, don’t forget to subscribe, rate, and review! Your support helps us bring more deep-dive crime investigations to your ears.

🔎 Stay Curious. Stay Vigilant. Stay on the right side of the Fine Line.

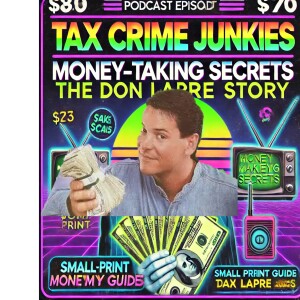

Wednesday Mar 19, 2025

Wednesday Mar 19, 2025

Doug Grant: Vitamins and Visions

Episode Summary:

In this episode of Tax Crime Junkies, we unravel the case of Doug Grant—a once-prominent nutritionist and supplement mogul who built a thriving business advising top-tier athletes, including the Phoenix Suns and Arizona Diamondbacks. But beyond the world of vitamins and fitness, Grant’s life took a sinister turn when his wife, Faylene, died under mysterious circumstances. Was it a tragic accident? A case of religious fanaticism? Or a carefully orchestrated crime?

Hosts Dominique Molina and Tom Gorczynski investigate the dark side of health and wealth, exploring Doug Grant’s tangled web of deception, life insurance intrigue, and his connection to notorious infomercial scammer Don Lapre. What started as a wellness empire ended with a shocking conviction—was Doug a grieving husband, or a manipulative mastermind who used faith as a weapon?

What You’ll Learn in This Episode:

How Doug Grant built a successful supplement empire and gained credibility as a professional nutritionist.

His connection to Don Lapre and The Greatest Vitamin in the World scam.

The psychological and financial elements behind Faylene Grant’s mysterious death.

How life insurance policies can become a motive for crime.

The role of religion, manipulation, and control in financial fraud cases.

Episode Highlights:

🔹 Vitamins, Lies, and Scandals: How Doug Grant’s career skyrocketed in the health and wellness industry—and how it all unraveled.🔹 A Marriage Sealed for Eternity… and Cut Short: The eerie writings of Faylene Grant foreshadowing her own death.🔹 A Second Honeymoon, A Fall Off a Cliff, and an Overdose in the Bathtub: The series of shocking events leading up to Faylene’s death.🔹 Motive or Coincidence?: Doug’s suspicious life insurance payouts and the fast-tracked wedding to his new wife, Hilary.🔹 The Trial & Sentencing: How the prosecution built its case, and why Doug Grant ultimately served time for manslaughter instead of murder.

Memorable Quotes:

💬 Dom: "Doug Grant sold the dream of health and longevity… but in the end, his own wife didn’t live to tell the tale."💬 Tom: "It’s one thing to sell fake vitamins. It’s another thing entirely to sell someone on their own death."💬 Dom: "Was Faylene truly convinced by visions, or was Doug pulling the strings all along?"

Resources & Links:

📌 Learn more at TaxCrimeJunkies.com📌 Follow us on social media: @taxcrimejunkies on Twitter & Instagram📌 If you enjoyed this episode, subscribe, rate, and review! Your support helps us keep exposing the wildest financial frauds and tax crime cases.

💡 Got a tip or a case suggestion? We’d love to hear from you! Reach out to us on social media or our website.

🎧 Next Week’s Episode Tease:Stay tuned as we dig into the bizarre world of fake deaths, missing millions, and offshore fraud in the next case of Tax Crime Junkies!

Wednesday Mar 12, 2025

Wednesday Mar 12, 2025

Episode Summary:In this episode of The Fine Line Files, we pull back the curtain on the art of deception used by financial fraudsters to create the illusion of success. From lavish lifestyles to fake business ventures, scammers have long understood that the key to credibility is looking the part. But how do they pull it off? And more importantly—how can you spot the red flags before it's too late?

Join Dominique as she unpacks the psychology behind financial scams, breaking down how fraudsters manipulate perception, why so many victims fall for the illusion, and how social media has supercharged the "fake it 'til you make it" mentality. From Don Lapre’s infomercial empire to modern-day Ponzi schemes, this episode reveals the tactics scammers use to appear wealthy while running financial frauds behind the scenes.

What You’ll Learn in This Episode:

The psychological tricks scammers use to appear legitimate.

Why fraudsters often spend more than they actually earn.

How social media has evolved the “fake it ‘til you make it” scam.

How Don Lapre built an empire on selling dreams—and what led to his downfall.

The warning signs of a financial scam disguised as a “once-in-a-lifetime opportunity.”

Key Takeaways:🔹 Luxury as a Disguise: Scammers flaunt wealth to build credibility—big houses, expensive cars, exotic vacations—all designed to make you believe they’re the real deal.🔹 Social Proof Manipulation: Fake testimonials, paid reviews, and staged success stories help create the illusion that others are profiting too.🔹 The Cycle of Fraud: Many financial fraudsters don’t start as scammers. They just keep digging deeper to maintain the illusion until everything collapses.🔹 Modern-Day Deception: Social media has made it easier than ever to manufacture fake success and lure unsuspecting victims into financial traps.

Memorable Quotes:💬 “If wealth is the ultimate credibility marker, then scammers have one job—make you believe they already have it.”💬 “A fraudster’s greatest tool isn’t just deception—it’s their audience’s willingness to believe.”💬 “Looking rich and being rich are two very different things. One builds wealth; the other builds a house of cards.”

Resources & Links:📌 Learn more about financial fraud and scam awareness at TaxCrimeJunkies.com.📌 Follow The Fine Line Files on Instagram @TaxCrimeJunkies for more deep dives into financial deception and fraud prevention.📌 If you enjoyed this episode, don’t forget to subscribe, leave a review, and share with a friend—because knowledge is the best defense against fraud!

🎙️ Stay curious. Stay vigilant. Stay on the right side of the fine line.

Wednesday Feb 26, 2025

Wednesday Feb 26, 2025

💰 From “tiny classified ads” to a $52 million fraud, Don Lapre sold the American Dream—until it all came crashing down.

Episode Summary

Don Lapre built an empire on late-night infomercials, promising ordinary Americans the secrets to financial freedom. With high-energy pitches and over-the-top claims, he became a household name in the ‘90s, convincing thousands of people that wealth was just a phone call away.

But behind the slick salesmanship was a tangled web of deception, multi-level marketing scams, and financial fraud that cost his followers millions. In this episode, Tax Crime Junkies hosts Dominique Molina and Tom Gorczynski uncover the rise and fall of the self-proclaimed “Infomercial King,” whose get-rich-quick schemes ultimately led to federal charges, financial ruin, and a tragic ending.

In This Episode:

🔹 Don Lapre’s humble beginnings and his first business failures🔹 How he used infomercials to sell the dream of wealth without a real product🔹 The infamous "tiny classified ads" scheme that made him millions🔹 His expansion into 900-number scams and "The Greatest Vitamin in the World" MLM🔹 How telemarketing fraud and tax evasion led to a federal indictment🔹 His shocking final days and the devastating impact on his followers

Key Quotes from the Episode

🗣 “Unlike other infomercials selling thigh masters and kitchen gadgets, Don Lapre wasn’t selling a product—he was selling a dream.”

🗣 “In the ‘90s, all you needed was a smooth sales pitch and late-night TV slots. Today, we call them influencers.”

🗣 “For decades, people believed in Don Lapre’s money-making secrets—until they realized the only one getting rich was him.”

Subscribe & Listen

📲 Available on Apple Podcasts, Spotify, or wherever you get your podcasts!

📩 Love the show? Leave us a review and share it with your fellow tax crime junkies!

Follow & Join the Conversation on X (Twitter)

🔗 @TaxCrimeJunkies – Your go-to source for tax crime stories and financial fraud exposés.

Meet the Tax Crime Junkies!

Dominique Molina is a CPA, speaker and teacher, leader of the American Institute of Certified Tax Planners, has a law degree and a real interest in true crime.

Tom Gorczynski is an EA, speaker and teacher, and admitted to practice in Federal Tax Court (USTCP). One might say Tom has an amateur education in avoiding murder from his love of true crime.

We decided to combine our love of tax and crime to bring you stories of greed, envy, and just plain stupidity in the creation of Tax Crime Junkies. Join us each week as we bring you more tales of white collar crime and the loopholes that went left.