Tax Crime Junkies

Tax Crime Junkies

The true crime podcast for people who love taxes, scandals, and stories too outrageous to deduct.

🎉 Over 50,000 downloads and counting!

🏆 Ranked #5 on Feedspot’s “30 Best White Collar Crime Podcasts Worth Listening to in 2025.”

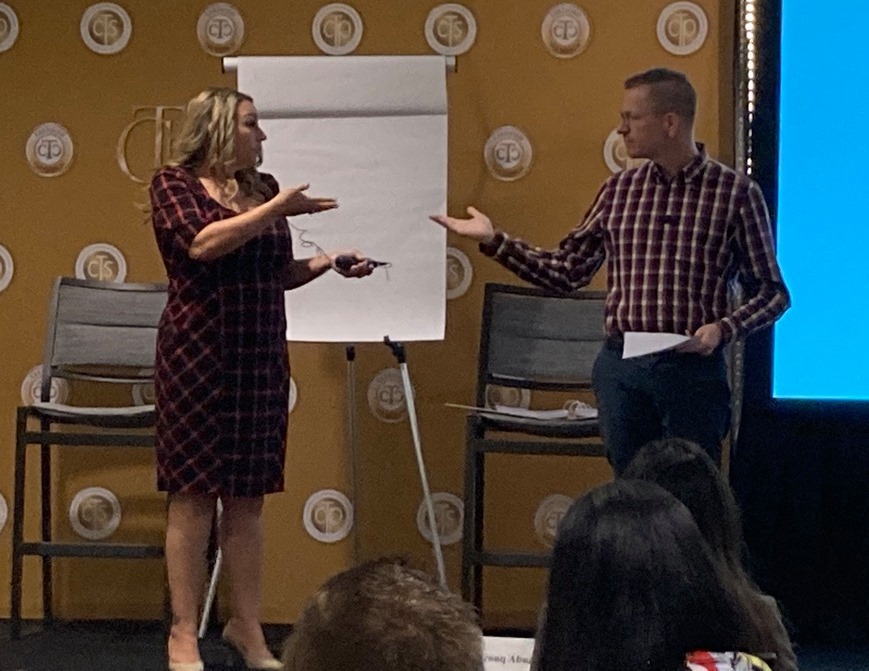

Hey there, Tax Crime Junkies! This is the true crime podcast where taxes meet temptation...and the numbers don’t always add up. Hosted by Dominique Molina, CPA, MST, CTS and Tom Gorczynski, EA, USTCP, CTP we follow the money trail through cases of fraud, embezzlement, tax evasion, and even homicide to uncover the shocking truth hiding behind the spreadsheets.

As tax experts and practitioners, we go beyond the headlines to explain how these crimes happen, why they go undetected for so long, and what ultimately exposes them. From financial schemes gone wrong to greed-fueled cover-ups, we reveal the human motives that turn ordinary people into criminals, and sometimes killers.

We’ve talked to investigators, lawyers, insiders, and even those who’ve served time to bring you gripping stories from the shadowy intersection of finance and crime. Along the way, we show what every taxpayer and business owner should know to stay safe, smart, and out of trouble.

New episodes drop every other week, combining investigative storytelling, expert insight, and unforgettable twists.

Whether you’re a tax professional, a true crime fan, or just fascinated by what people will do for money, Tax Crime Junkies will keep you hooked from the first clue to the final confession. Subscribe wherever you get your podcasts, leave a five-star review, and join us as we follow every trail — all the way to the truth.

Episodes

Thursday Sep 07, 2023

Thursday Sep 07, 2023

Episode Title: Desperate Deals: The Rise and Fall of a King and His Tax Castle

Episode Summary:

In this gripping episode of Tax Crime Junkies, hosts Dom and Tom delve into the shocking true story of King Isaac Umoren, a tax preparer turned criminal mastermind. From impersonating an FBI agent to selling a fraudulent tax business, Umoren's tale is a cautionary one, filled with deceit, audacity, and a web of lies that ensnared not just him but also his employees and clients.

What You'll Learn:

How King Isaac Umoren used his tax preparation business as a front for multiple fraudulent schemes.

The emotional and financial toll on the victims, including the staff and the new owners of the fraudulent business.

The legal consequences Umoren faced, including 18 charges related to the fraudulent business sale.

Insights into the IRS investigation and the patterns of fraud detected.

Key Moments:

Introduction (00:00-03:00): Dominique and Tom set the stage with a relatable problem—clients failing to pay for services—and introduce the main story.

The Impersonation Act (03:01-08:00): The hosts describe Umoren's audacious impersonation of an FBI agent and how it led to his initial arrest.

The Fraudulent Business Sale (08:01-15:00): Learn how Umoren sold his tax business based on inflated values and fraudulent documents, fooling the new owners.

The Human Toll (15:01-20:00): Dominique and Tom discuss the impact of Umoren's actions on his employees, who were left jobless and financially strained.

The Legal Consequences (20:01-25:00): The hosts delve into the charges Umoren faced and how his actions caught up with him.

IRS Investigation (25:01-30:00): Tom explains the IRS's role in uncovering the fraudulent activities within the tax preparation business.

The Downfall (30:01-35:00): The story comes full circle, reflecting on the broader implications of unchecked ambition and deceit.

Conclusion and Teaser for Next Episode (35:01-36:00): The hosts wrap up the episode and tease what's coming up next on Tax Crime Junkies.

Subscribe & Share:

If you enjoyed this episode, please consider subscribing and sharing it with friends who could use a tax crime junky podcast in their life. Help us spread the word and come back for more!

Legal Disclaimer:

This podcast is for entertainment purposes only. All facts are sourced from public records or similar, and the episode is not intended to defame or misrepresent anyone involved.

Next Episode:

Stay tuned for our next episode, where we'll bring you more stories of tax and financial crimes—and how to avoid even the appearance of impropriety. We'll be starting a 2 part series on How Sarma Melngailis, Queen of Vegan Cuisine, Became a Runaway Tax Fugitive

Wednesday Aug 09, 2023

Wednesday Aug 09, 2023

Key Takeaways:

The Facade of Luxury: Michael Banuelos, aka Ferrari Mike, portrayed a life of luxury, but it was all built on lies.

A Web of Deceit: Michael's scams ranged from fake concert tours to counterfeit documentation, defrauding investors of over $2 million.

A Shocking Past: Michael's criminal activities date back to his time as a deputy sheriff in Los Angeles.

The Victims: From aspiring artists to seasoned investors, many were ensnared in Michael's web of deceit.

Facing the Music: The evidence against Michael was overwhelming, leading to a recommended 63-month prison sentence.

Connect with Us:

Website: TaxCrimeJunkies.com

Instagram: @TaxCrimeJunkies

Twitter:@TaxCrimeJunkies

Leave a Review: If you enjoyed this episode, please leave us a review on Apple Podcasts or wherever you listen to podcasts. Your feedback helps us bring more intriguing stories to you.

Disclaimer: All information in this episode is based on publicly available data and is intended for entertainment purposes only. Always consult with a professional before taking any action based on the content of this podcast.

Tuesday Aug 01, 2023

Tuesday Aug 01, 2023

In this episode, Dominique and Tom dive into the multi million dollar music fraud scheme of Michael Banuelos, better known as Ferrari Mike. From 2005 to 2012, Mike swindled nearly 3 million dollars out of multiple investors all while living the high life off of their hard earned money. He makes himself out to be a big shot with impressive connections to top recording artists like Ludacris, Usher and Chris Brown. He even produces a fake video of his home on MTV Cribs to convince people of how strong his connections are. By preying on the dreams of aspiring musicians and investors interested in their careers, he uses forged documents from major recording label Def Jam Records to convince people to give him hundreds of thousands of dollars. But all is not as it seems with Ferrari Mike. He may look like a real VIP with his luxurious lifestyle, but he had not truly earned a single cent of it. In fact, he had not done an honest day's work since 1997.

Talking Points:

Who is Ferrari Mike?

From 2005 to 2012 Mike swindles multiple groups of people out of millions

Mike claims he has professional connections to Ludacris and Def Jam Records

Musician Four Eyes’ testimony about his relationship with Ferrari Mike

Mike produces a video and fakes that his own home is being featured in an episode of MTV Cribs

Mike’s victims include The Vern L and Ty T Investor Groups, and the musical duo Highlife

Mike forges documents from a major recording label and the employee whose name was forged ends up committing suicide. Mike uses this as an excuse to explain why the deal wasn’t able to be finalized.

In February 2009, Mike claims Chris Brown can’t meet with Ty T because of the legal troubles with his domestic violence charge against Rihanna

Then, Mike offers Ty for Highlife to be the opening act for Usher’s tour if he just scrapes up an additional $10K.

Gerald S. falls into Mike’s trap when he receives a memorandum of understanding dated October 9, 2008 between Def Jam Music Group and Michael. Memorandum claims Def Jam will pay 23 million dollars for the rights to HighLife’s performances. Gerald invests $100,000.

Between 2009 and 2010, Gerald poured even more money into Mike’s fraudulent deals including a $340,000 investment for the supposed deal with Sony who Mike claimed was offering $285 million for the rights to musician Brian White.

In July 2012, Ferrari Mike was finally arrested.

Mike continues attempting to defraud people from prison claiming his arrest was a misunderstanding.

What did Mike do with all that money?

Mike did not have an honest job since being a deputy in 1997.

Find out the shocking truth behind this master manipulator and his devastating impact on the lives of aspiring artists in Part 2!

Podcast production and show notes provided by HiveCast.fm

Tuesday Jul 25, 2023

Tuesday Jul 25, 2023

In this episode, Dom & Tom discuss the case of Ralph Baldenegro, a former firefighter and current inmate, who took over two decades to solve. Baldenegro, a 42-year-old former firefighter, worked as security for the firm and had left the Santa Clara Fire Department in disgrace a few years earlier after an assault conviction and dismissal. The podcast explores the circumstances that led Baldenegro to turn from a protector to a perpetrator, and how DNA linked him to the brutal murder scene at Bucalo's South Meridian Avenue cottage.

The podcast also touches on the complexities of the tax and legal system and the lessons learned from the case. Baldenegro was charged with special-circumstances murder, attempted rape, and burglary, but it took over two decades to bring charges for Julie's murder.

The case began with Julie's boyfriend, Jim Kent, who was the last person to see her alive. Kent called the local flooring store to check on Bucalo, but his calls went unanswered. On Monday, Kent called the local flooring store to check on Bucalo, but the house remained silent. Kent and his friend Nick called the police, and they found Bucalo's home eerily silent. The police arrived, and the case remained for nearly 20 years. Baldenegro's arrival was not a complete surprise, as they had a friendly conversation at work. The podcast highlights the importance of understanding the complexities of the tax and legal system and the importance of pursuing justice when faced with a tragic case.

The story revolves around the crimes of Ralph Baldenegro, who was known for stalking and assaulting women. Baldenegro was arrested and his DNA was obtained, but he pleaded not guilty to the charges related to Julie Bucalo's case. The case also involved two other heroines, Linda A and DM, who reported being raped and assaulted by Baldenegro. The police found a pattern of using handcuffs, duct tape, and weapons like knives. Despite his weaponry, Baldenegro pleaded not guilty to the charges related to Julie Bucalo's case, and his lawyer called the prosecution a waste of judicial resources.

The story also touches on the experiences of other heroines, such as Janet P, who claimed that Baldenegro pinned her to the bed after accusing her of infidelity in 1982 and slapping her and strangling her. Sarah Griffith, once a girlfriend of Baldenegro, claimed that he assaulted her multiple times in 1984, and these incidents bore chilling similarities to his attack on Julie Bucalo. Baldenegro denied assaulting, binding, and raping Sarah G., and when interviewed, Baldenegro claimed the two were a couple and that Sarah G wanted to have his baby.

The hearsay rule against hearsay evidence protects constitutional rights, as it can affect someone's right to a fair trial, support the due process rights of defendants, and allow the right to confront and cross-examine witnesses. However, allowing hearsay without limitation would undermine this right, making it difficult to obtain evidence that happened outside of court to prove a case. Hearsay evidence can be admitted if it falls under certain exceptions, such as presenting motive or showing a pattern in the defendant's behavior. This exception allows for the use of hearsay evidence to show someone's state of mind at the time, as seen in the case of Julie Bucalo.

The justice system's handling of earlier assaults and the benefits of DNA evidence in cold cases are discussed. The jury found Ralph Baldenegro, 64, guilty of the 1991 slaying of the 26-year-old San Jose accountant, and he will spend the rest of his life in prison. The CHP chased Baldenegro for about a half-hour, and he eventually surrendered and his son was found unharmed. The episode highlights the importance of thorough investigation, especially DNA testing, safety measures, and justice, even in delayed cases. The episode also emphasizes the importance of perseverance and the need for continuous improvement in the justice system.

Tuesday Jul 18, 2023

Tuesday Jul 18, 2023

Trigger WARNING: This episode contains discussions of extreme acts of violence with guns in the workplace. Listeners take care.

While some people are able to receive constructive criticism and move on, others can obsess on what they see as a failure, and when they blame their boss, co-workers, or even just the person that does the firing.

This is the story of Anthony LaCalamita, who, after being fired during tax season, plotted the worst revenge possible against his co-workers and boss at the accounting firm where he worked.

Tuesday Jun 20, 2023

Tuesday Jun 20, 2023

In this episode, Tax Pros Dominique and Tom discuss the recent case of billionaire Russian bank magnate Oleg Tinkov, who pleaded guilty to tax fraud and agreed to pay over $500 million for misrepresenting his net worth on a tax form. Join us as we delve into the details of the case and offer tips and advice to help listeners avoid making similar mistakes when it comes to taxes.

Key takeaways:

The importance of being honest and accurate when reporting your net worth and income on tax forms

Understanding the tax laws and regulations that apply to you, especially if you are a high-net worth individual or a U.S. citizen living abroad

The consequences of tax fraud, which can include significant fines, penalties, and even prison time

The importance of seeking professional help and advice when it comes to tax planning and compliance

This episode provides valuable insights and practical tips for anyone looking to ensure they are in compliance with tax laws and regulations and avoid any potential legal trouble. Tune in now!

Tuesday Jun 13, 2023

Tuesday Jun 13, 2023

In this episode, CPAs Dominique and Tom discuss the life, death, and tax crimes of John McAfee!

Dominique and Tom, unpack part 2 of a story about John McAfee, a tech pioneer and libertarian who was also a fugitive on the run. The hosts unpacked a lot about his colorful and controversial life in the previous episode and continue to do so in this one. They start by discussing what happened to the dead dogs in McAfee's backyard and reveal that the government had cut off their heads to look for bullets. They also delve into McAfee's biotech start-up called QuorumEx, which aimed to develop natural antibiotics with plants in the Belizean rainforest. However, there were doubts about his authenticity as he weirdly told a reporter that he and his colleagues were searching for an herbal version of Viagra for women. McAfee's female business partner and researcher, Ms. Adonizio, had a fallout with him and accused him of being a horrible person, controlling, manipulative, and dangerous. So many layers to the mans story and you are in for a rollercoaster of a ride!

Tune in now!

Tuesday Jun 06, 2023

Tuesday Jun 06, 2023

Episodes Notes:

In this episode, CPA Dominique and EA Tom discuss the life, death, and tax crimes of John McAfee!

Dominique and Tom, introduce a two-part series on the life and death of John McAfee. John was the founder of the first antivirus software company and was a tech pioneer who made millions of dollars. He was also a fugitive who claimed to be hunted by government agencies and drug cartels alike. He had run-ins with the IRS for not filing tax returns for over a decade. John used various tactics to hide his income and assets from the IRS, such as directing his income to bank accounts and cryptocurrency exchange accounts held in the names of nominees and using shell companies and trusts to hold his properties and assets. He fled the country in 2019 when he was facing charges related to a cryptocurrency scam. He was arrested in Spain in October 2020 and extradited to the United States in March 2021. John pleaded not guilty to the tax evasion charges but was found dead in his prison cell in Barcelona just hours after a Spanish court agreed to extradite him to the US to face tax evasion charges. There were rumors that he was killed off like Epstein, but it is unknown if that is true. Dom and Tom discuss John's impact on the tech industry and the irony that he never used his own antivirus software on his computers. Join us!

Introduction: The episode opens with an overview of the case, introducing John McAfee and Gregory Faull as neighbors living in Ambergris Caye.

Tension and Conflict: We discuss the strained relationship between McAfee and Faull, exploring Faull's impatience with unleashed dogs and his encounters with the aggressive animals as he made his way to a nearby beach bar.

Suspicion Arises: The show delves into the events leading up to the dogs' death and Faull becoming the prime suspect due to his expressed desire to harm the animals.

A Shocking Discovery: The episode takes a dramatic turn as Faull is found dead the following day, laying in a pool of blood with a 9mm bullet casing nearby. McAfee becomes the primary "person of interest" in the case.

Investigation and Scrutiny: We delve into the investigations that ensued, examining the intense scrutiny placed on McAfee, given his complex relationship with Faull and his proximity to the crime scene.

Twists and Turns: The show uncovers the riveting twists and turns that surround the case, including McAfee's response to being implicated and the global media attention that followed.

Unanswered Questions: We explore the lingering questions surrounding Faull's death, the ongoing investigation, and the mounting intrigue surrounding McAfee's involvement.

The Legacy of the Case: The episode reflects on the lasting impact of this chilling chapter in the life of John McAfee and its implications for his future endeavors.

Tuesday May 30, 2023

Tuesday May 30, 2023

This episode concludes the twisted saga of a tax attorney’s vengeance, putting together the last of the puzzle pieces to finally determine just what happened to Ashley Pallow. When we last left off, there had already been multiple tax crimes and four murders associated with this case. Michelle was in jail for an unrelated charge and new witness Christopher Higgins had just entered the scene. Christopher, another former employee of Ashley’s, takes the story in a whole new direction when he comes forward to state that Thomas confessed to murdering Ashley, in great detail, while they were having lunch together at a Chili’s. He claims to have murdered Ashley in an attempt to protect Michelle. Although the autopsy results do not fully corroborate the details of Chris’ story, Thomas is ultimately found guilty and sentenced to life in prison.

Talking Points:

Michelle’s phone conversations with Thomas are monitored while she is in jail. She is heard promising to take the fall for Thomas as long as he promises to raise her children

Another tax preparer and former employee of Ashley, Christopher Higgins steps up with a completely different story of events. Casual conversation in a Chili’s between Thomas and Christopher took a turn when they started talking about OJ Simpson

Thomas explains to Chris in detail his reasons for killing Ashley. He claims to have hit Ashley so hard that he broke his jaw. He states that he called Michelle for help with the body

The last time Thomas had seen his boss, Ashley had said that someone was stealing from him. He believed it to be Michelle and was thinking about turning her in. If she was reported, it would violate her probation. Thomas decided to kill Ashley to protect Michelle

The initial autopsy results reveal there is not enough damage to Ashley’s jaw, face, and chest considering the force that strangulation would have required

Michelle asks Thomas on the phone call while in jail for details about how the death occurred so that she could sound more convincing

Thomas is found guilty, convicted of first degree murder and sentenced to life. Michelle is charged with accessory after the fact and a 30 year sentence

Thomas’ lawyer contends that Thomas never got a fair trial, submits a request for a new trial but is denied

The state becomes aware of another potential witness, Samantha Friar, who is cellmates with Michelle. She claims that Michelle admitted to killing Ashley during consensual sex

Another inmate comes forward about hearing Michelle and Samantha conspiring to fabricate a confession

Samantha introduces the idea that Ashley was a drug addict

2017 letter written by Michelle claiming that everything she had said was out of fear of losing her children

Years before Ashley’s murder, his brother Adam was killed by the police while he was in police custody at 29 years old

In 2021, Ashley’s son Matthew was shot and killed by police when he was just 28 years old. He called 911 for psychiatric help during an episode and was shot and killed

The potential dangers of toxic work environments

Podcast production and show notes provided by HiveCast.fm

Tuesday May 23, 2023

Tuesday May 23, 2023

This episode unveils the twisted saga of a tax attorney’s vengeance that resulted in not one, but multiple murders. Ashley Pallow was a tax attorney from St. Lucie, Florida who had a bit of a reputation for being aggressive and for pushing the boundaries of the law. Incredibly, Ashley himself had been charged with murder prior to his own, but was acquitted due to lack of evidence. Ashley seems to be a magnet for murder! Just six months before ending up dead and wrapped in an acid-covered rug in his storm cellar, a man named John Wilson attempted to murder Ashley for having an alleged affair with his girlfriend. After the police find Ashley’s body, they investigate two of his tax employees, Thomas Bard and Michelle Lockridge who had been the last people thought to see Ashley alive. In response to her arrest, Michelle discloses that she was having a paid sexual relationship with Ashley and that his death had been accidental, but later she changes her story to blame Thomas. To make matters even more confusing, another witness, Christopher Higgins, has a different story for what happened to Ashley, sending the investigation in a new direction.

Talking Points:

Who was Ashley Pallow and what was he like according to his family and employees

What Ashley’s tax office at home was like

In 2000, Ashley is charged with 3rd degree murder and charges are dropped

January 2010, Ashley is arrested on charges of organized dealing in stolen property and 2nd degree grand theft

Jane Hoffman, a former employee, calls in a welfare check on Ashley and the police discover that he is missing. The sheriff’s office offers a $50,000 reward provided by Ashley’s father for information leading to the arrest or conviction of the person or persons responsible

Ashley’s body is discovered in a storm cellar on his own property wrapped in a rug, covered in acid

Another person by the name of John Wilson had been arrested six months earlier for trying to kill Ashley. He was convinced his girlfriend was having an affair with Ashley. Earlier that day, he murdered his own mother and so he was in jail at the time of Ashley’s murder

Police investigate two long time employees of Ashley’s, Thomas Bard and Michelle Lockridge. They provide conflicting stories of their last time seeing their boss

Michelle had a prior tax crime history for embezzlement

Michelle is arrested and afterward her children go to live with her dad. Her 10 year old daughter is then murdered and found wrapped in a white dress in the woods near their home. The prime suspect is Michelle’s 15 year old son

March 2016, the brother admits to shooting his sister but gives three different versions of the story

Michelle claims she had a sexual relationship with Ashley and that he paid her and several of her friends for sex. She says that he wanted her to choke him and that the asphyxiation was accidental. She claims Thomas helped her hide the body

Later, Michelle changes her story and says Thomas killed Ashley

Another witness, Christopher Higgins, has a different story. Tune in for Part 2 to see how it changes the investigation!

Quotes

“Yeah that might be a little uncomfortable for me…he sounds just like a typical tax pro.“ (4:09-4:43 | Dominique)

"As more information surfaces, Ashley's story becomes even more unbelievable. It turns out that he had once been charged with murder himself!" (8:03-8:16 | Tom)

Podcast production and show notes provided by HiveCast.fm

Meet the Tax Crime Junkies!

Dominique Molina is a CPA, speaker and teacher, leader of the American Institute of Certified Tax Planners, has a law degree and a real interest in true crime.

Tom Gorczynski is an EA, speaker and teacher, and admitted to practice in Federal Tax Court (USTCP). One might say Tom has an amateur education in avoiding murder from his love of true crime.

We decided to combine our love of tax and crime to bring you stories of greed, envy, and just plain stupidity in the creation of Tax Crime Junkies. Join us each week as we bring you more tales of white collar crime and the loopholes that went left.